A large part of Trading 212’s draw is its fees. Without a doubt, this platform is one of the cheapest in the market.

What you pay will depend on the products and services you use.

Trading 212 INVEST

If you want to invest in stocks, and ETFs (including in an Sometimes called an investment ISA, a stocks and shares ISA is an individual savings account that allows you to invest in shares, unit trusts, investment funds, and bonds. You will not need to pay tax on any income or capital gains earned on investments within an ISAISA ), here’s what you won’t pay:

), here’s what you won’t pay:

Trading commission

Custody fees

Here’s what you will pay:

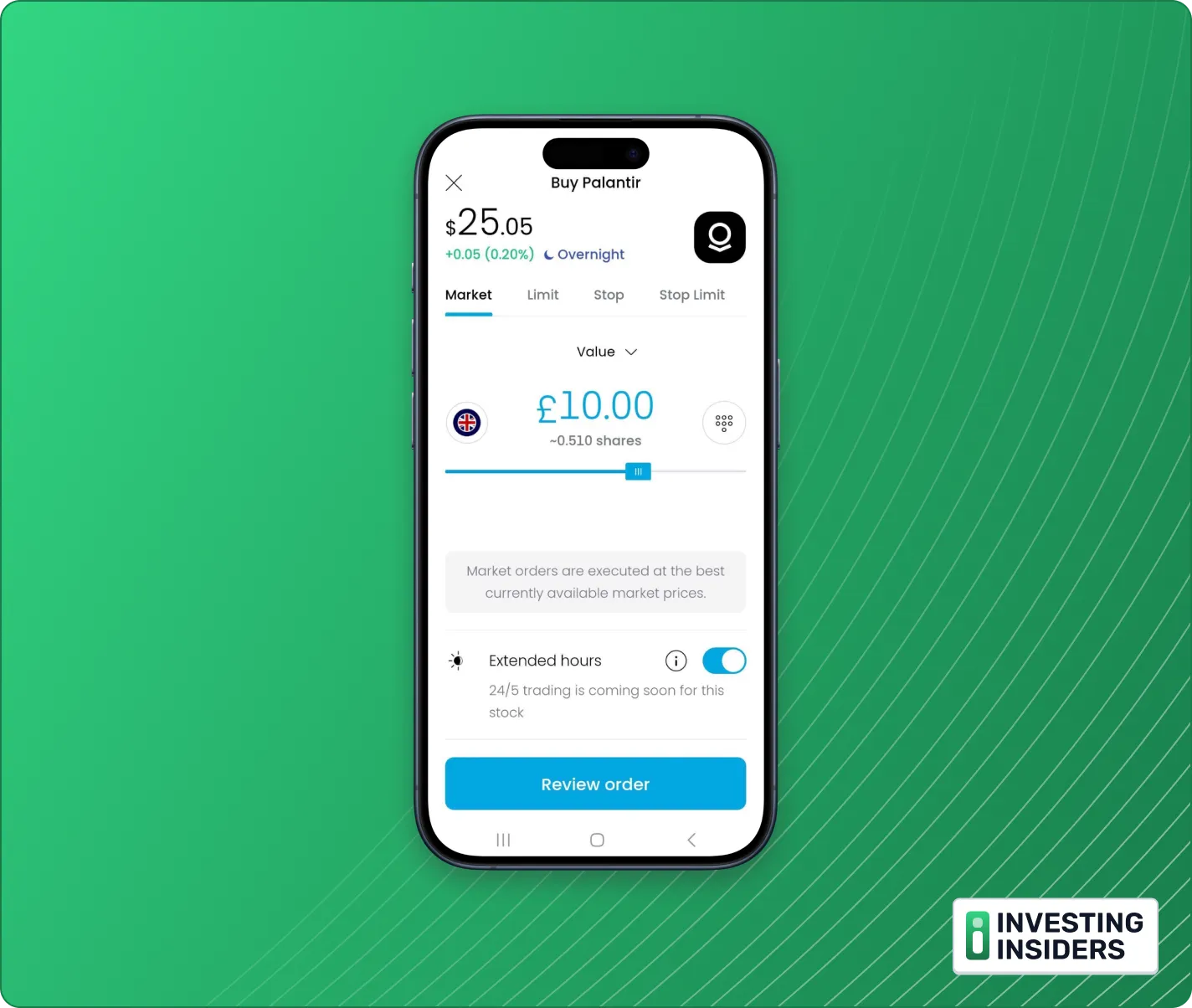

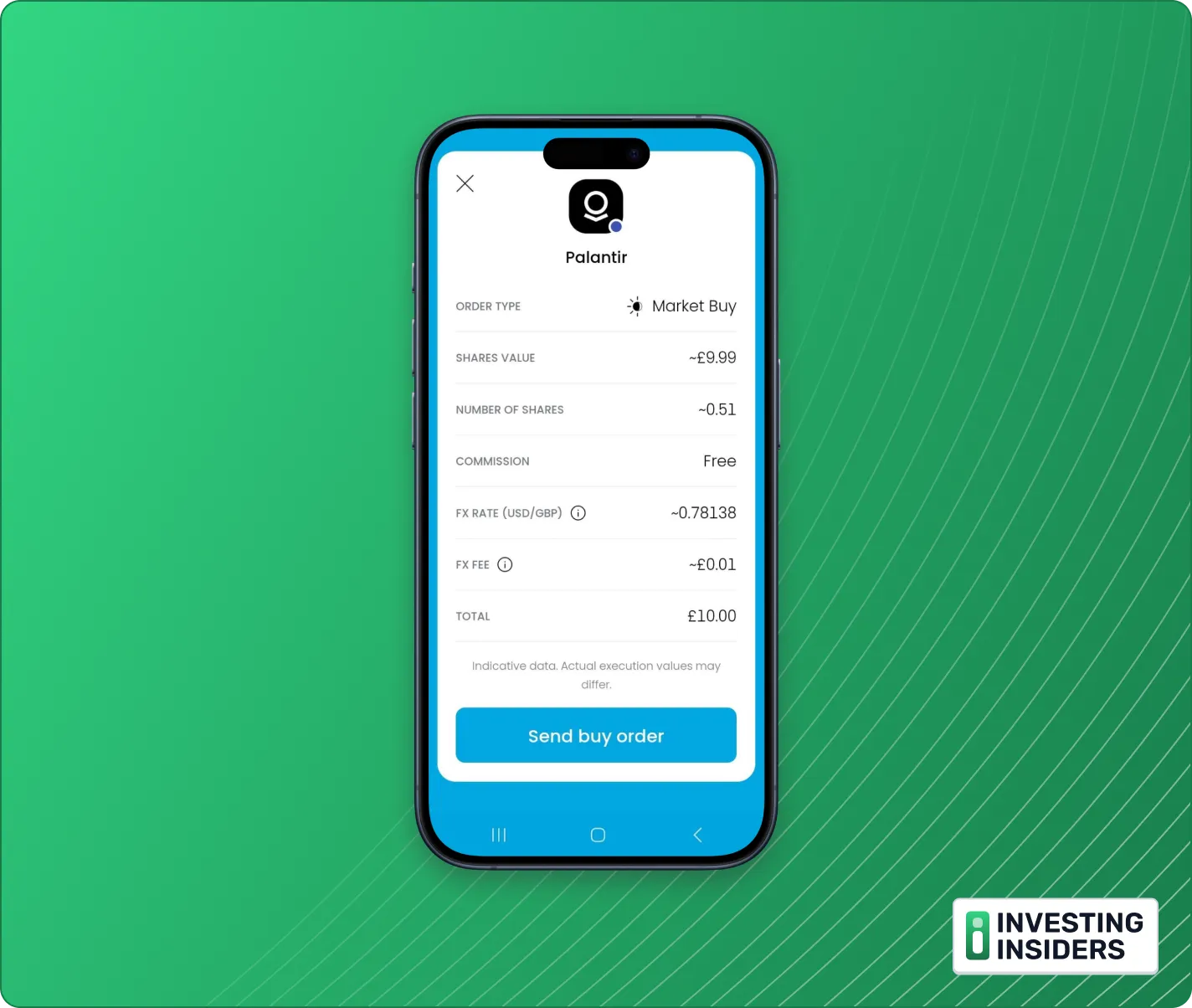

- A foreign exchange (FX) fee is added to all trades involving foreign currencies. If you buy a stock that trades in US dollars, for example, and your home account is in GB pounds, you’ll need to pay an FX fee.FX fees

If you invest in non-GBP stocks and ETFs, you’ll pay currency conversion (FX) fees at 0.15%.

FX rates as low as 0.15% are rare, as you can see from this comparison table:

There’s more good news in that FX fees can technically be avoided with T212: Trading 212 Invest is a multi-currency account that allows you to hold money and trade in multiple currencies. This means, if you really don’t want to have to convert money and incur FX fees each time you trade in a different currency, you can do avoid it by holding money in different currencies. Of course, in reality, if you just want to spend you earnings in the UK, you’re probably not going to do this, but if you split your time between the UK and the US, for example, this works for you.

You’ll notice from the comparison table that Interactive Brokers (IBKR) is the only broker to offer lower FX fees as standard. If you’re weighing up the choice of IBKR vs Trading 212, there are two things to note:

To use IBKR, you’ll need to feel comfortable with a much more complex platform. Test it first using a demo account if you want to get a taste of how much more complex it is.

IBKR charges a commission on its trades, which T212 does not. Commission starts at 1% for Fractional shares are portions of shares (or ETFs) that are smaller than one whole share. They are designed to make ownership of large, expensive shares more accessible.

fractional shares and 0.05% for whole shares. You may find it is still cheaper than Trading 212 if you’re factoring in FX fees, but both platforms are highly competitive and the differences may be marginal.

and 0.05% for whole shares. You may find it is still cheaper than Trading 212 if you’re factoring in FX fees, but both platforms are highly competitive and the differences may be marginal.

Let’s add a few other providers into the mix. Let’s imagine we bought 12 stocks over the course of one year, within an ISA, at each of these providers:

And the conclusion is… Trading 212 is cheap.

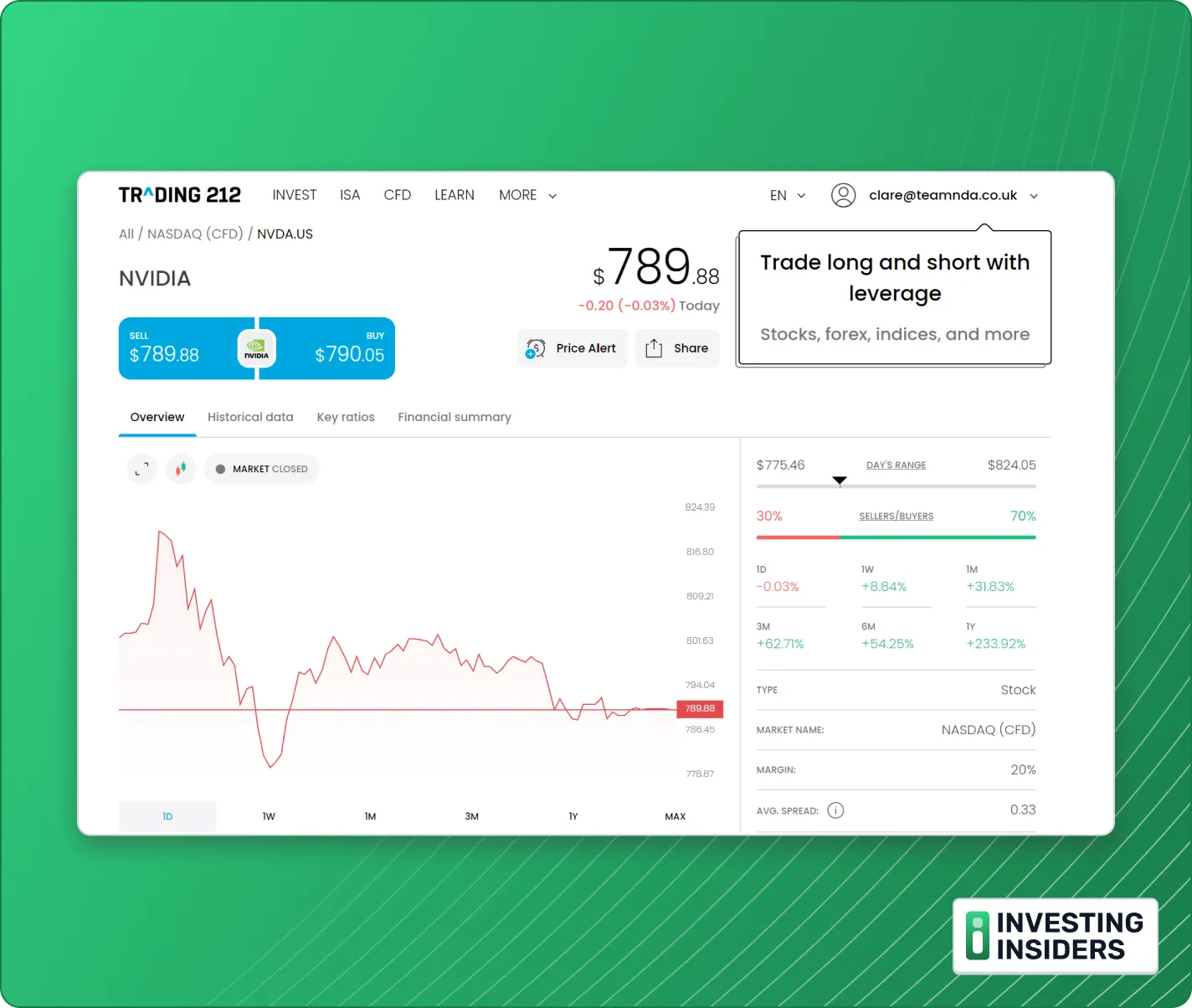

Trading 212 CFD

If you want to trade using CFDs on T212, here’s what you won’t pay:

Trading commission

Custody fees

Here’s what you will pay:

Spreads are dynamic and change depending on the underlying market conditions.

Trading 212’s spreads are typically very low. Here are two examples of what you’d be paying at current rates on other platforms vs Trading 212:

Interactive Brokers is T212’s main competitor on price, with Saxo also in the mix. But T212’s 0.5% FX fees on forex and CFDs mean IBKR often comes out the cheapest.

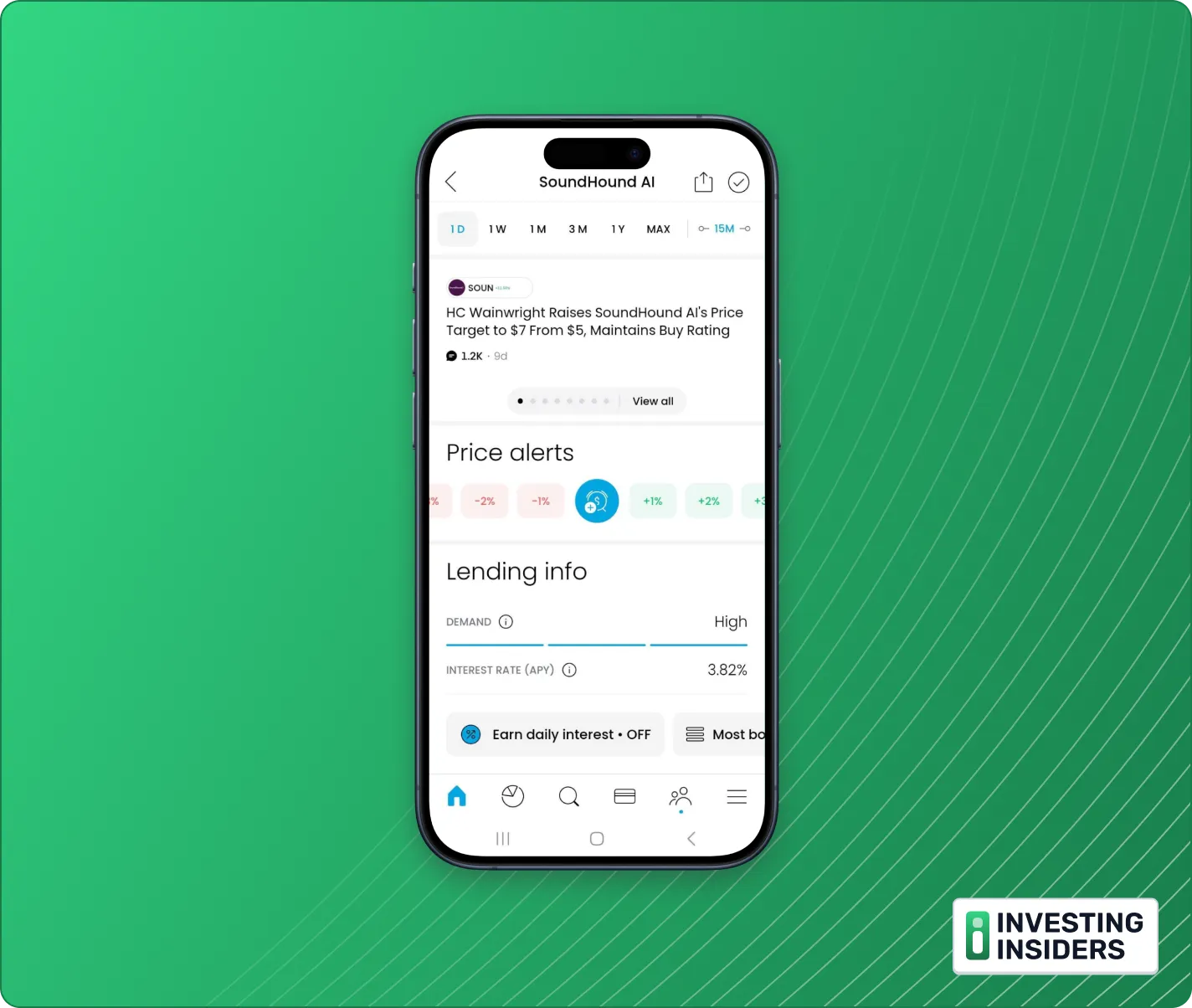

Any CFD positions held in your account past 10 pm will incur an overnight holding fee. The fee can be positive or negative, depending on the direction of the trade and the product. You can find the fees for each instrument in the app, listed on its ‘Instrument details’ page.

- FX (currency conversion) fees

As you may have spotted in the tables above, T212 charges a higher currency conversion rate of 0.5% for CFD trades.

You’ll only pay it on results, however, and there is that option to hold cash and trade in more than one currency with T212.

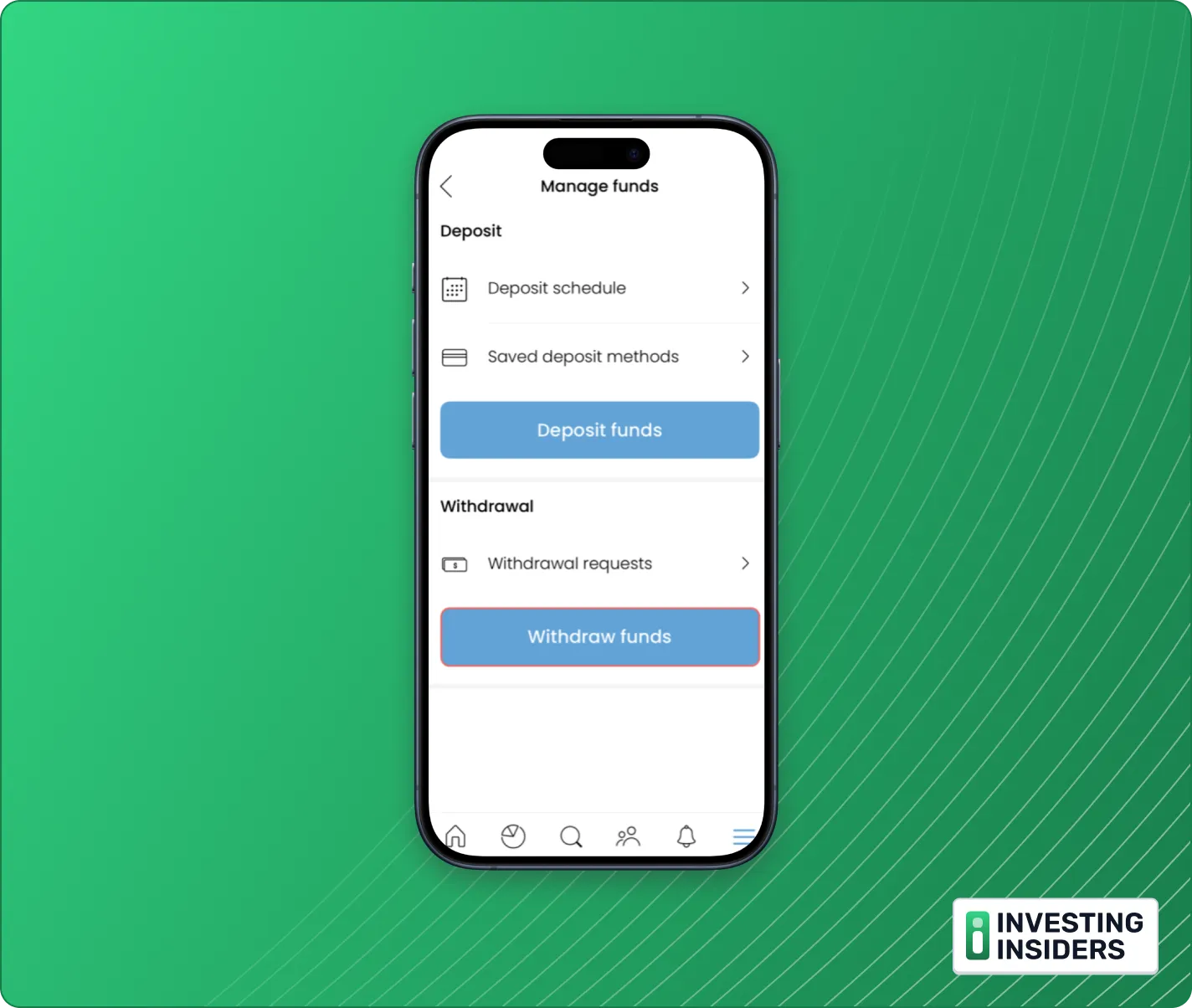

Withdrawal fees

It is free to withdraw funds from your T212 account.

Deposit fees

All bank transfers into T212 accounts are free.

There’s no charge for credit or debit card payments and Apple/Google Pay on transfers under £2,000. For figures over that, a 0.7% fee is applied.

Minimum deposit

£1.

Interest paid on cash

Trading 212’s big marketing push right now is around its 5.00% interest rate on uninvested cash. It’s certainly worth shouting about as it’s the highest I’ve found (unless you have more than $250k with eToro).

For comparison:

Disclosure

Disclosure

Share

Share

Fact

Checked

Fact

Checked

Best for UK investors

Best for UK investors

FCA approved

FCA approved

More info

More info

Read More

Read More

Verdict

Verdict

Available

Available Not available

Not available