Antonia says

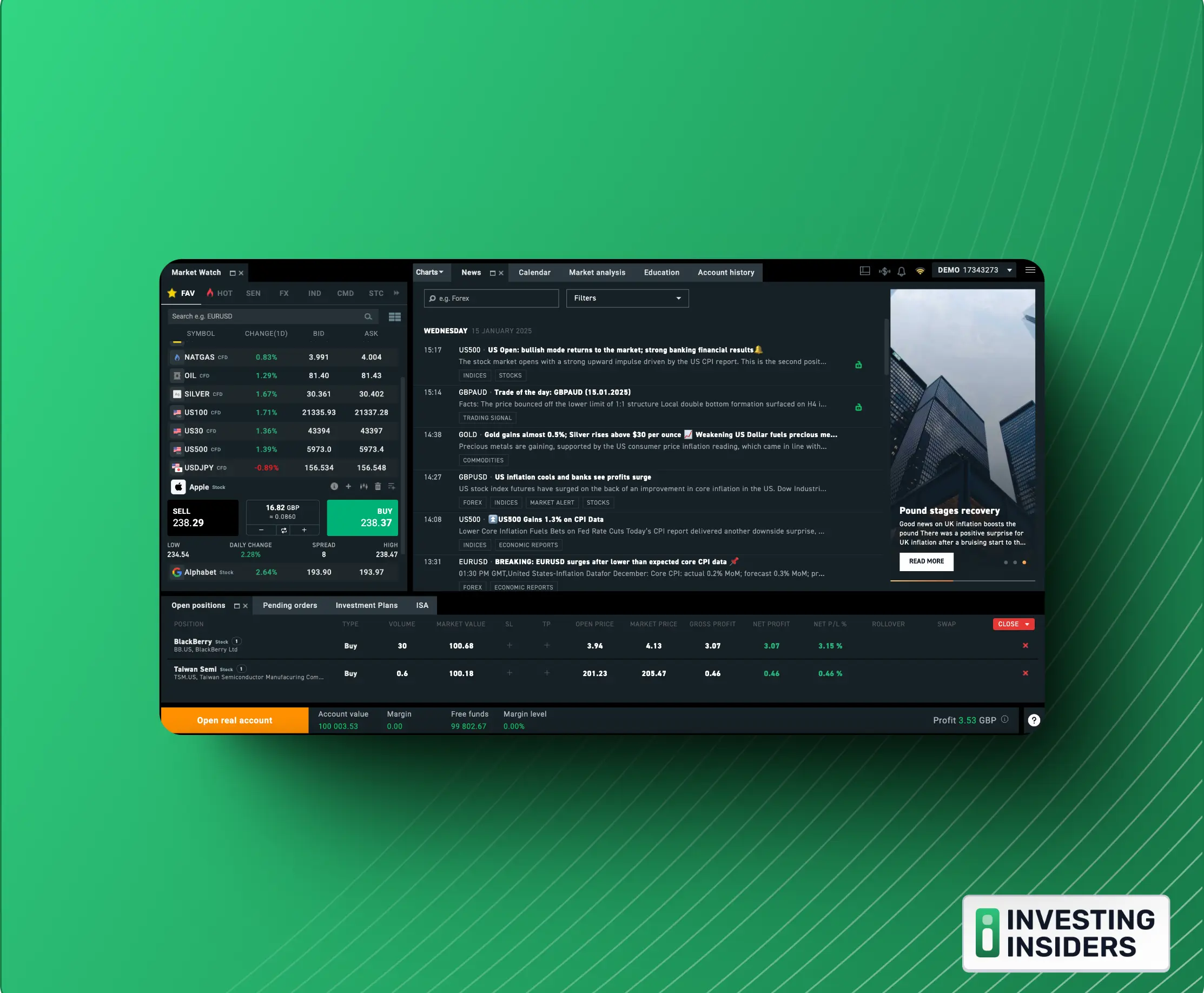

XTB offers both short-term trading through CFDs and longer-term investment opportunities through real stocks and ETFs. Choose from a General investment account (GIA) is an account designed to provide access to investments. You may be liable for tax on any income or capital gains earned within a general investment account but this can be a useful vehicle for anyone who has maxed out their ISA allowanceGeneral Investment Account , or a free,If an ISA is flexible, you’re able to withdraw money and pay it back in, without it counting twice within your annual ISA allowance. It must be repaid within the same tax year it’s withdrawn to be eligible, however.flexible stocks and shares ISA

, or a free,If an ISA is flexible, you’re able to withdraw money and pay it back in, without it counting twice within your annual ISA allowance. It must be repaid within the same tax year it’s withdrawn to be eligible, however.flexible stocks and shares ISA .

.

The big draw of XTB is its ultra low pricing: zero commission when buying or selling real stocks and ETFs, unless you are investing more than £100,000 per month, in which case you’d pay 0.2% of the trade value. With no annual account fees, no deposit fees, and no withdrawal charges on amounts over £50, you’re getting a free account if you’re buying/selling UK stocks or ETFs, or trading CFDs. If you want to invest in US or other non-UK stocks, the 0.5% currency conversion (FX) charge is reasonable too. And XTB allows users to set up multiple accounts in different currencies, so you could potentially avoid, or lower your currency conversion costs. (Here’s how.)

There’s a great rate of interest paid on uninvested cash, too – currently 4.75%.

Where XTB falls down slightly is in its range of assets. It’s not as wide as some other, more established platforms. It also doesn’t offer ready-made portfolios, so there are no managed options which can be a great way in if you’re a beginner, although it does offer Exchange traded funds (ETFs) are traded in much the same way as stocks. Instead of an individual stock, however, you own a basket of different assets which track the performance of a particular index or market. ETFs .

.

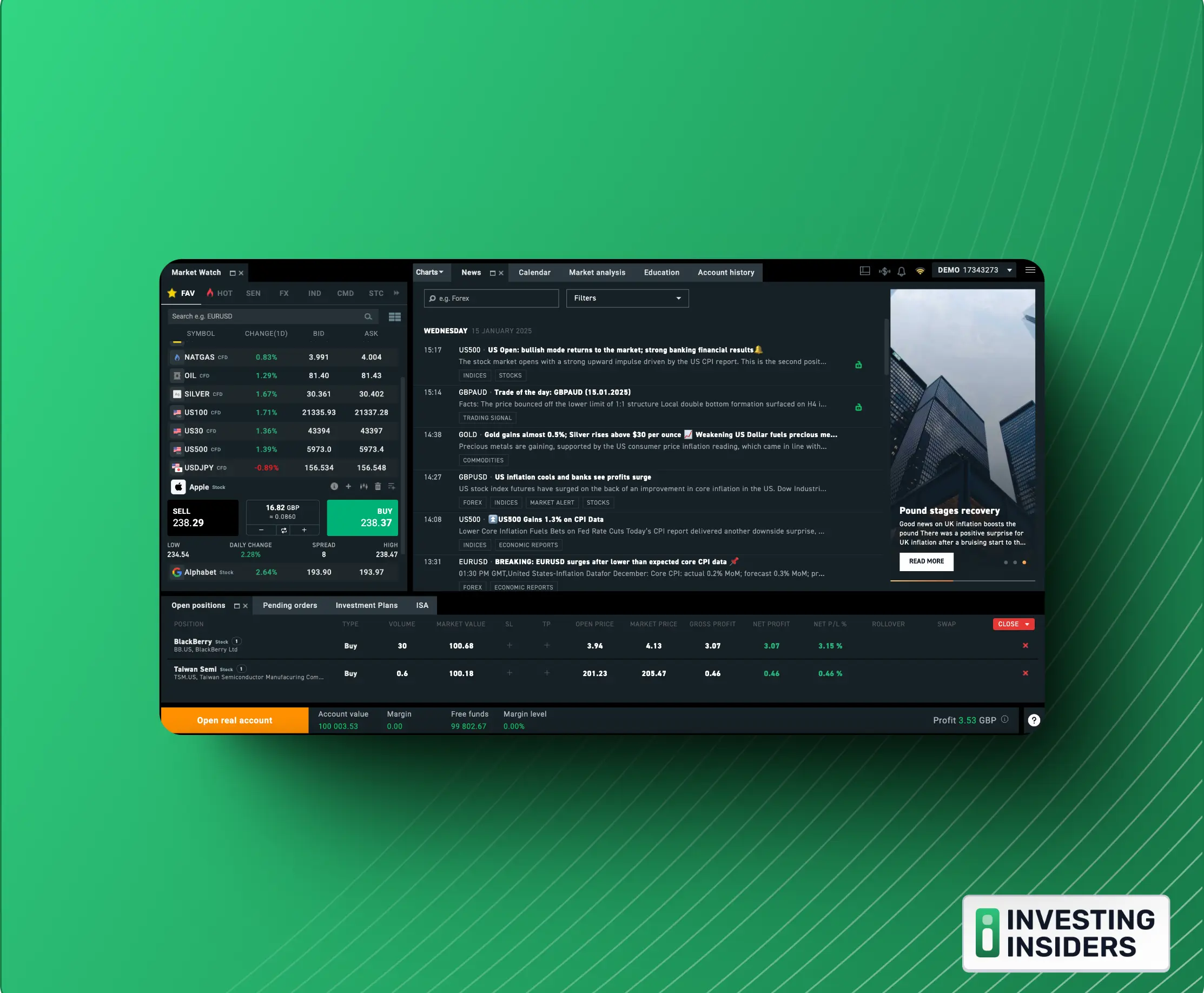

The other issue is that there’s just one interface to invest/trade on, and it takes a bit of confidence and commitment to navigate, so it’s not ideal for beginners. The education offering is excellent at XTB, so you can get help, but a platform that also offers CFDs comes with added complications.

Use this is

You are an intermediate level investor/trader looking for the lowest cost platform.

Fees

Zero commission on real stocks and ETFs (unless your turnover is £100k+ per month in which case you’ll pay 0.2% commission)

Zero commission on CFD trading

0.5% currency conversion charge

Zero deposit or withdrawal fees (unless withdrawing less than £50 in which case a £5 fee applies)

Zero annual account/management fees

Investments

Stocks

ETFs

CFDs on stocks, forex, indices, commodities

Fact Checked

Fact Checked

Disclosure

Disclosure

Share

Share