Some platforms only allow you to hold a balance in a single currency – GBP if you reside in the United Kingdom. This usually means that when you trade in other currencies like EUR or USD, a currency conversion will need to take place. If your provider allows you to hold more than one currency in your trading account, then you can make trades in the same currency as your asset (provided the currency is one your provider allows you to hold).

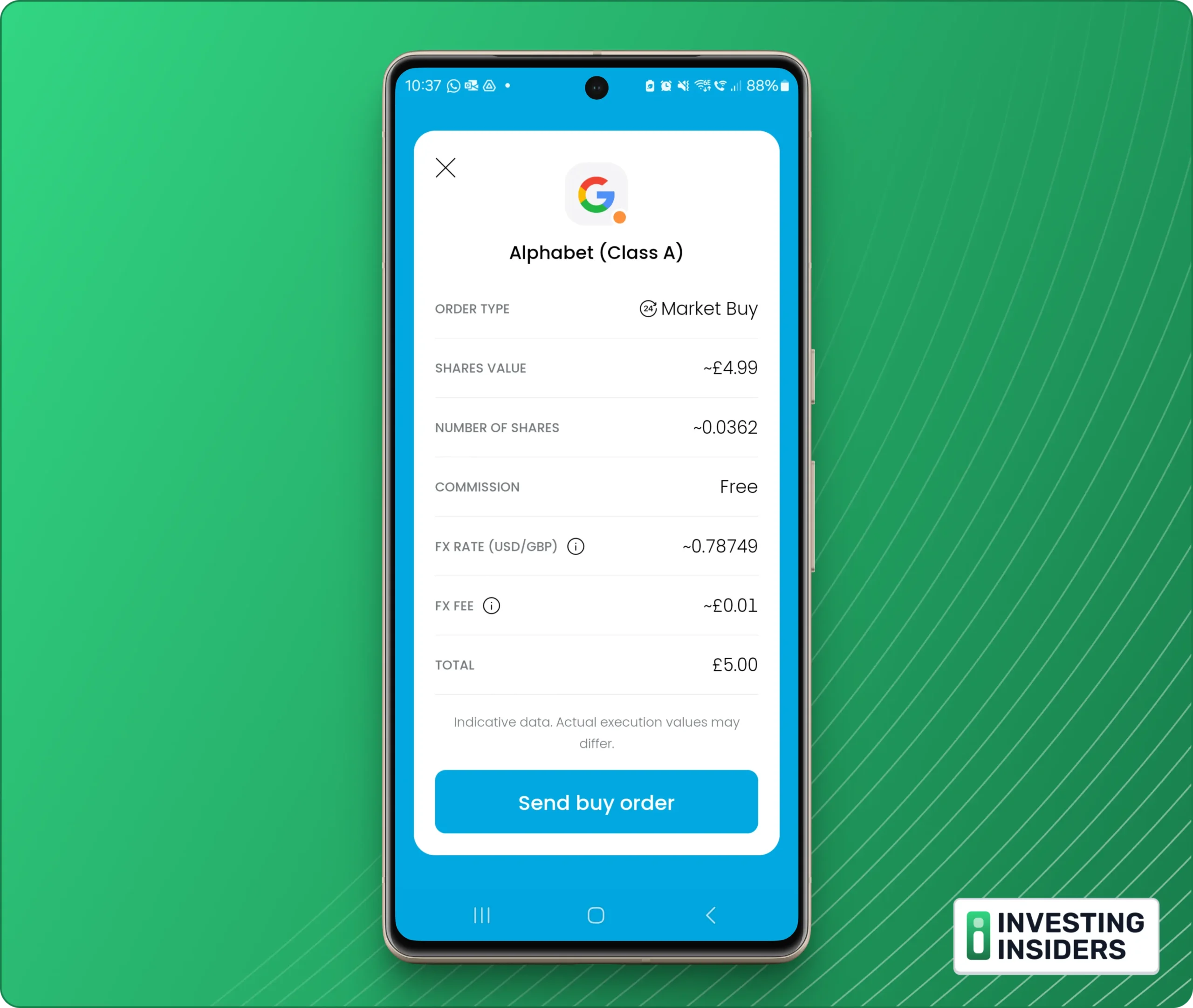

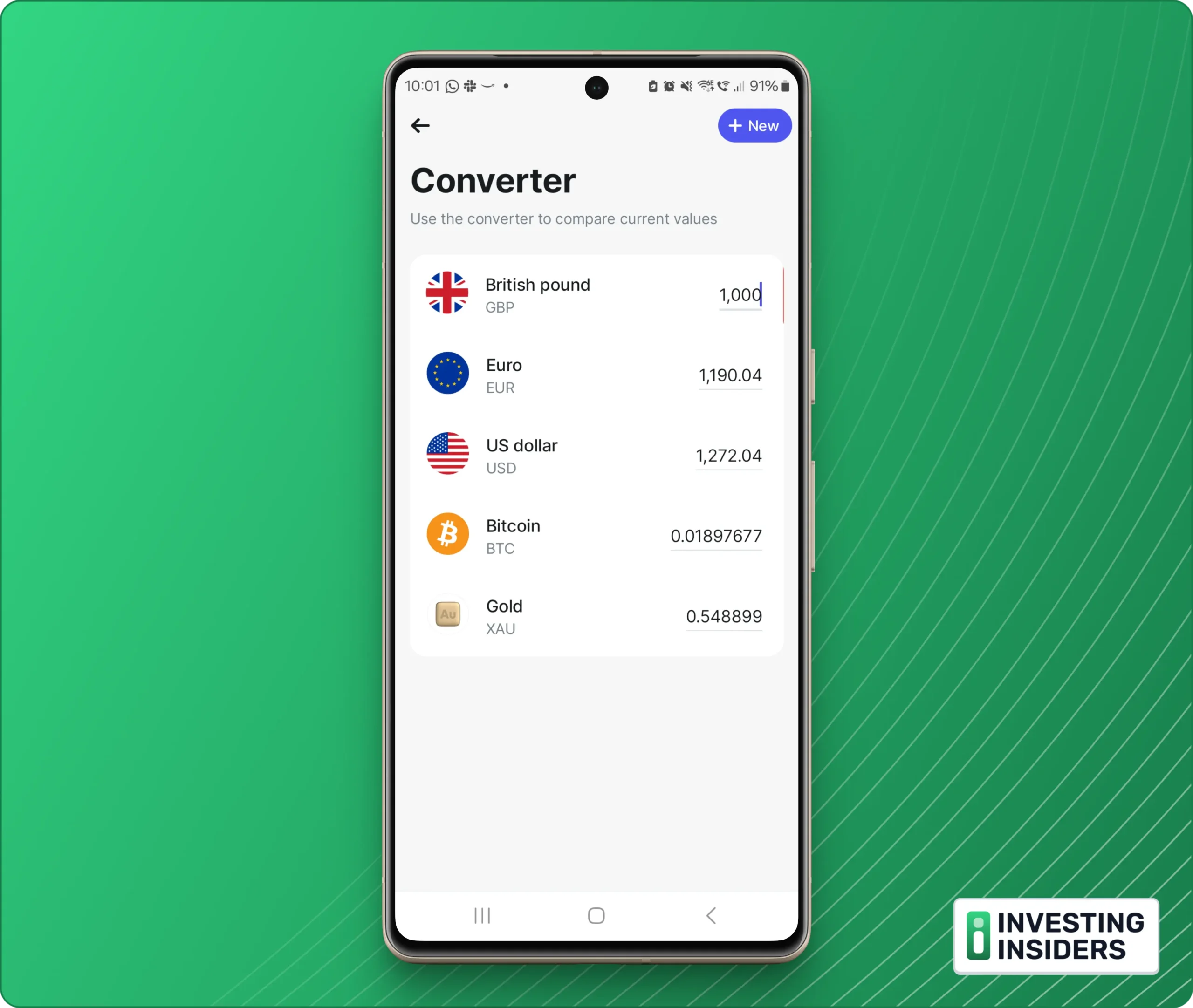

Trading 212

Trading 212 Invest allows for multi-currency trading. That means you can deposit, withdraw and trade in up to 12 currencies.

Those 12 currencies are: GBP, USD, EUR, CHF, DKK, NOK, PLN, SEK, CZK, RON, BGN, and HUF.

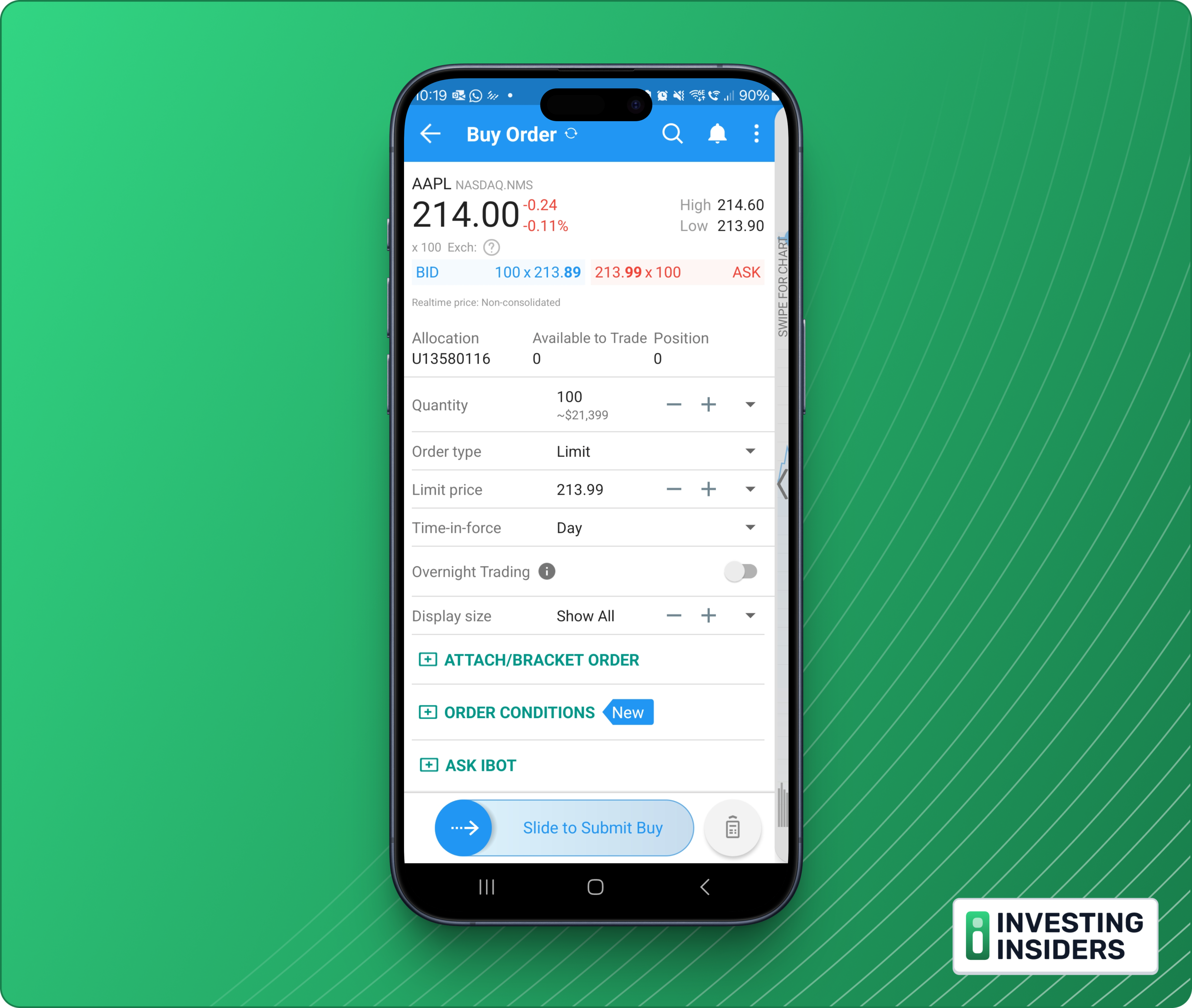

Interactive Brokers

With IBKR, you’ll need to designate a single base currency. That’s what you’ll get your statements denominated in. However, deposits and withdrawals may be made in any non-base currency in AUD, CAD, CNH/CNY, CHF, CZK, DKK, EUR, GBP, HKD, HUF, INR, JPY, MXN, NOK, NZD, SEK, SGD or USD.

Interactive Brokers also offers a link-up with Wise which means you can initiate fund transfers between your Wise multi-currency account and your IBKR account more quickly. It could also help reduce transfer fees as transferring funds to IBKR using Wise Balance is fixed and costs around $0.39. Funds are immediately available for trading when they appear in the account.

interactive investor

ii allows you to fund your account in both GBP and non-sterling currencies. Currently you can hold: Euros, US dollars, Canadian Dollars, Australian Dollars, Hong Kong Dollars, Singapore Dollars, Swedish Krona, and Swiss Francs.

Unlike Interactive Brokers, however, there’s no direct hook-up with Wise. In fact, ii does not accept third party payments or payments from any money transfer/FX companies. So, Wise isn’t going to be a go-er. You could use Revolut or though as they offer a if you’re using a service like Wise, or Revolut etc, you’ll need to transfer it into your bank account first.

Saxo

Saxo allow you to fund and deposit your account in 18 different currencies, or open sub-accounts to switch between different currencies. (Sub-accounts are only available to Platinum and VIP clients, however.)

You can open an account in the following currencies: AED, AUD, CAD, CHF, CNH, CZK, DKK, EUR, GBP, HKD, HUF, ILS, JPY, MXN, NOK, NZD, PLN, RON, TRY, SEK, SGD, ZAR, USD

High street banks

The following high street banks offer multi-currency accounts:

HSBC

Barclays

NatWest

Lloyds Bank

However, some banks only offer multi-currency accounts to businesses, and exchange rates and FX fees at high street banks tend to be at the very top end of the price scale so I’d highly advise shopping around for alternatives.

Fact Checked

Fact Checked

Disclosure

Disclosure

Share

Share