The Verdict

Average Success Rate

Beanstalk 5-Year Avg

Beanstalk 5-Year Avg

The following dataset includes the performances of ready-made portfolios/funds offered by investment platforms and may include both actively and passively managed ready-made portfolios/funds. Performance indicated is also net of all fees to 31st January 2024, unless stated otherwise; any tiered fee structure will be disclosed. Ready-made portfolios/funds that include cryptocurrencies or any other securities outside cash and equities are not included in the dataset.

The dataset only includes ready-made portfolios/funds which are explicitly advertised by their respective platforms as being for ‘beginners’, and which are exclusively offered by the platform itself. Funds which are managed by other providers and may be identically offered across multiple platforms were not included in this dataset. For example, the Vanguard UK All Share Acc. ETF was offered by Plum, but as it is not directly managed by Plum and customers could reasonably access it on multiple platforms, it was not included for the purposes of this research. Other discretely advertised securities or investments are not included.

Industry avg.

Industry avg.

The industry average is the median average of all fund/ready-made portfolio performance figures we collated from 23 investment providers. To see the full dataset, visit X page.

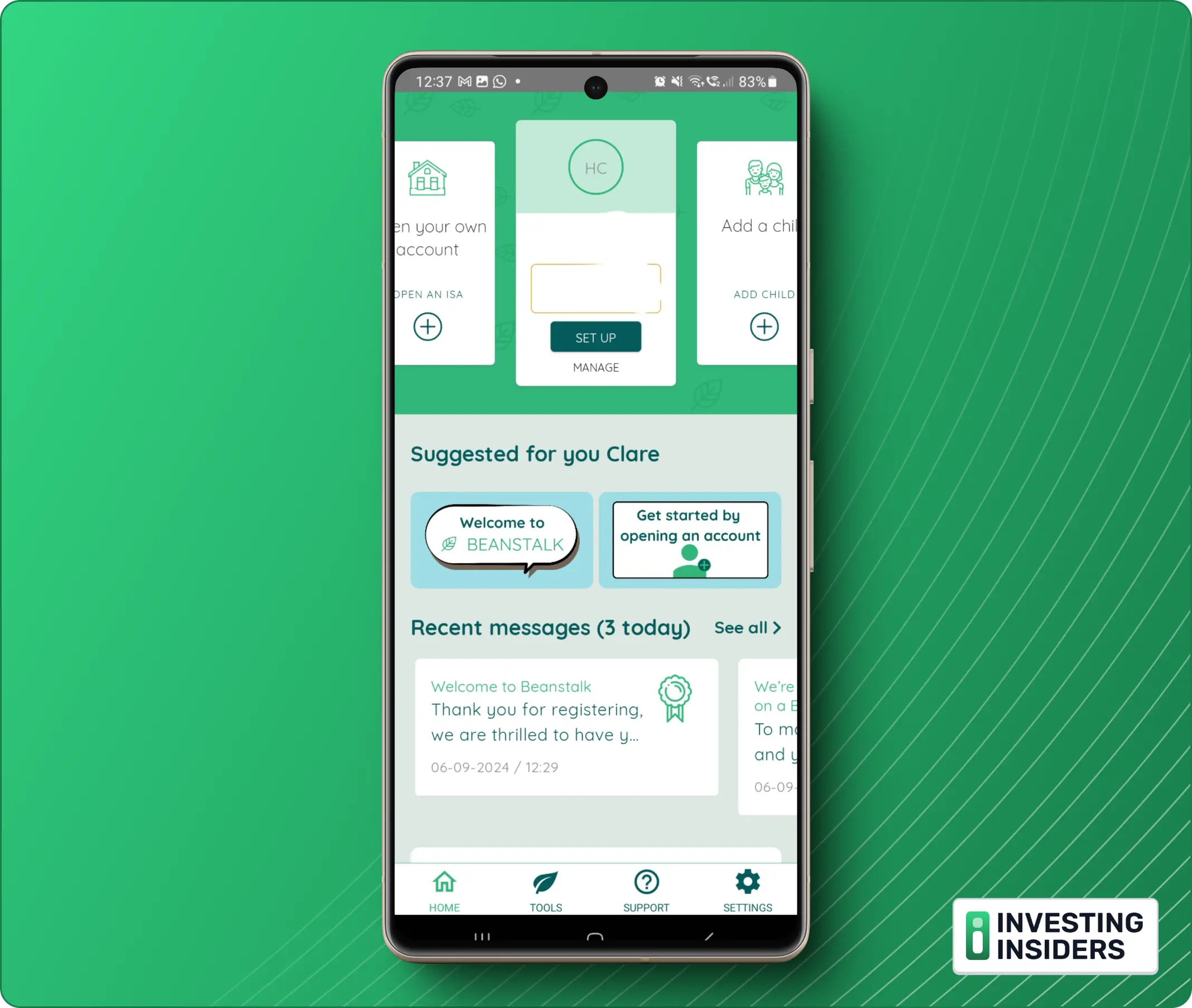

If you're a parent who is short of time (is there any other kind?) and have a pang of guilt when you're reminded you haven't yet arranged a savings or investment fund for your child, then Beanstalk might just be for you. Beanstalk's Junior ISAs and adult ISAs are designed to get you up-and-running as quickly and easily as possible.

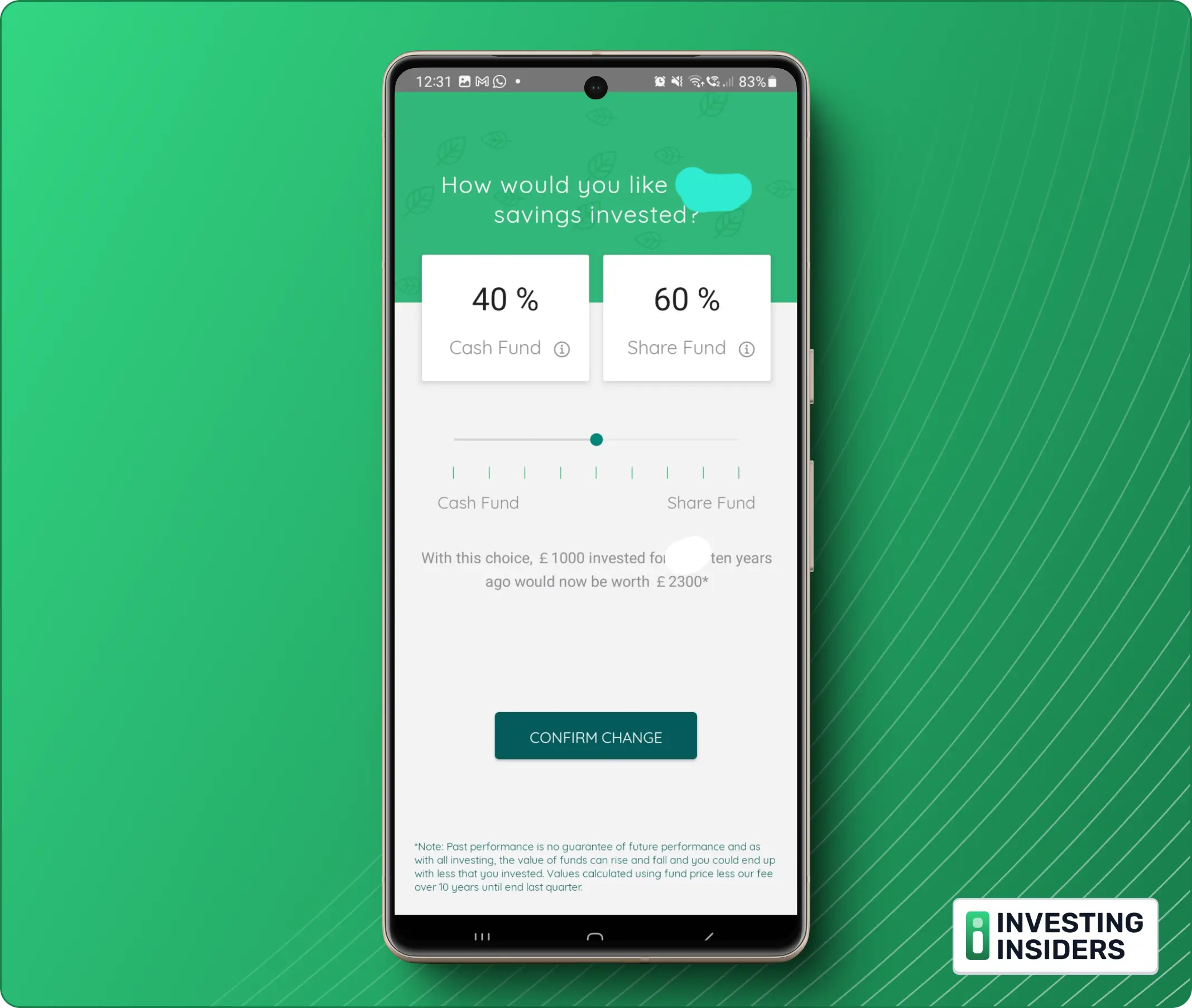

Beanstalk have designed a process that makes it about as simple to get set-up and investing as you'll find anywhere. However, there's always got to be a trade-off somewhere, and the trade-off here is that you won't get much choice over how your money is invested. In fact, with just two funds to choose from, you'll find less choice with Beanstalk than any other investment provider I think I've reviewed.

For many people, that will be far too restrictive. But for others - it will be a bonus. No difficult decisions to make, and no need for any prior knowledge about investing. The only thing Beanstalk ask you to decide is how much of your investment you want kept in a cash fund, and how much you want to invest into a stocks and shares

Tracker funds are ‘passive’ investments as they simply aim to mirror the performance of a benchmark, such as the FTSE 100.

They are run by computer algorithms rather than fund managers, so they're cheaper than actively managed funds, but still ensure you get a diversified portfolio. A tracker can never outperform the market or index it is linked to – it will only ever follow it. An Exchange Traded Fund (ETF) is an example of a tracker fund.tracker fund

.

On fees, Beanstalk is reasonably priced if you consider how much of the work is being done for you and how quick and easy it is to get going. There is one annual fee (charged monthly) of 0.5% of your investment amount plus a fund fee of either 0.12% or 0.15%. There are cheaper ISAs and Junior ISAs (JISAs) out there, but there are also plenty that are far more expensive, so that's really not too bad, especially considering you're paying for such convenience and all of the research done for you. Plus there are a couple of really nice account benefits such as the ability to invite friends and family to donate to your child's JISA, spending round-ups, and cashback on purchases that goes directly into your child's JISA account.

Beanstalk will be far too simple for many investors. But if your aim is simply to get some money growing for yourself or your child's future, and you know that if it's too complicated you'll probably not get around to it, then Beanstalk is certainly an option to consider. It's an app that understands the needs of busy, overwhelmed parents and serves its audience well.

Read More

Read More

Pros

- Quick and easy way to get an ISA/JISA up and running

- Easy to invite family and friends to contribute

- Ability to adjust how much you want invested in equities, and how much in lower risk cash fund

- Very easy-to-use app

- Simple sign-up

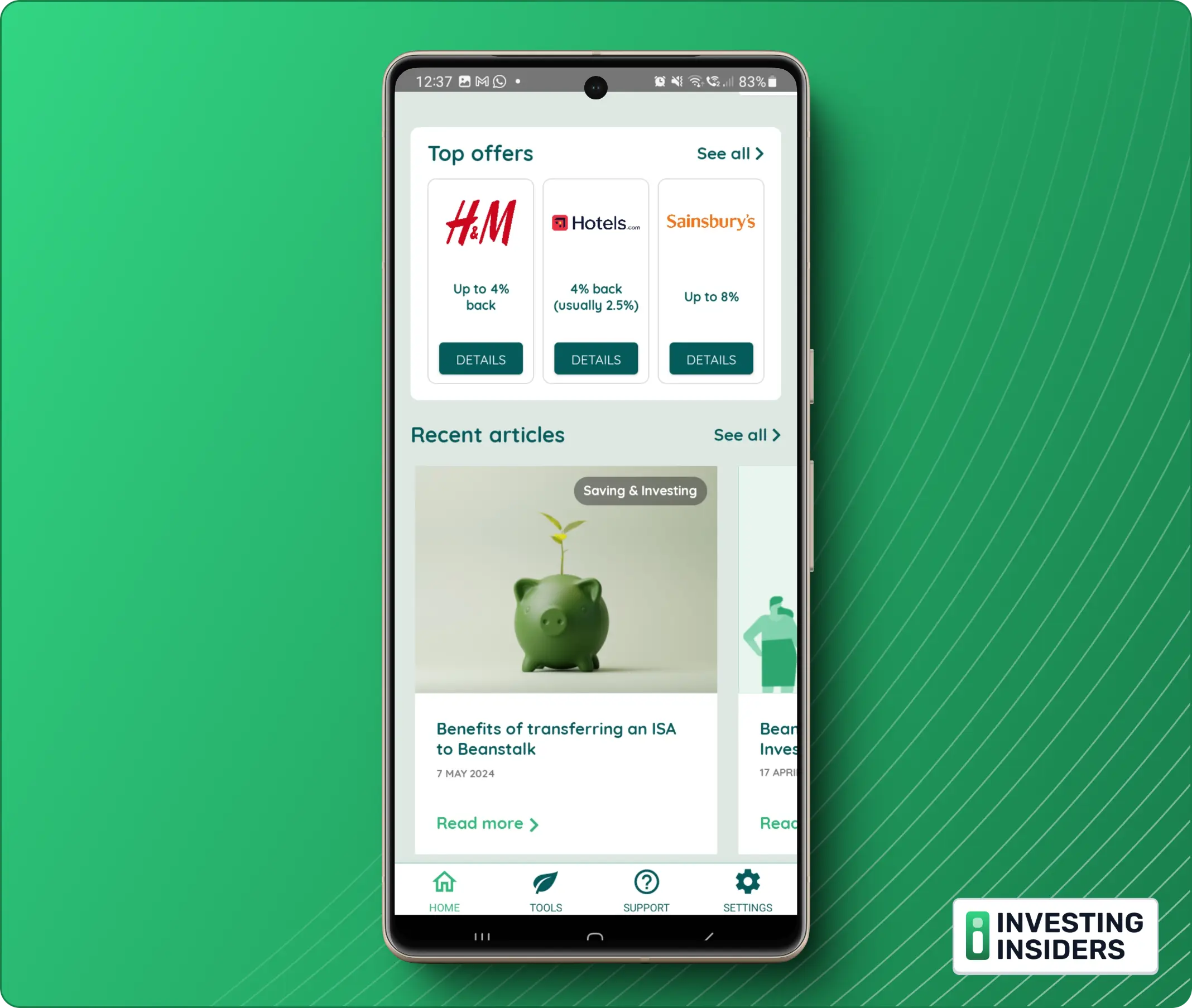

- Cashback on spending at some retailers

- If an ISA is flexible, you’re able to withdraw money and pay it back in, without it counting twice within your annual ISA allowance. It must be repaid within the same tax year it's withdrawn to be eligible, however.Flexible ISA

and Junior ISA accepts transfers from Child Trust Funds

and Junior ISA accepts transfers from Child Trust Funds

Cons

- Just two funds to choose from

- Not the cheapest way to invest in an ISA/JISA

- No investment advice available

- No immediate-response customer support

Account Opening

Account opening is as easy as can be. It took me less than 5 minutes to register and it was a very smooth, frictionless process. You'll need to download the app. The QR code for the app is on the Beanstalk website if you can't find it, but it's available in both the Apple and Google Play stores.

The process for getting your ISA or Junior ISA set-up and to schedule regular standing order / Direct Debit transactions or a one-off bank transfer is easy to understand and I didn't encounter any bugs with the app.

Pros

- 5 mins to open an account

- Fully digital process

- Documents needed: National Insurance number, existing Child Trust Fund details for a transfer to a JISA

- Child Trust Fund transfers done by Beanstalk

Cons

- Paper form must be sent for authorisation to transfer Child Trust Fund to Junior ISA

Research

As there's not much to choose between with Beanstalk, there's not much by way of research. However, both funds have accompanying fact sheets, allowing you to view information on the type of fund it is, where your money goes, and past performance data.

Pros

- Fund fact sheets detail past performance data and other key information

Cons

- No other research tools available

Safety

All money and investments held through the Beanstalk app are covered by Financial Conduct Authority (FCA) client money and asset rules, meaning they are held not by Beanstalk themselves, but by a custody provider who are authorised and regulated by the FCA to protect customer monies and investments.

Even though Beanstalk isn't an bank, it is still regulated by the FCA, and investments are covered up to £85,000 under the Financial Services Compensation Scheme.

Pros

- Regulated by the Financial Conduct Authority

- Investments covered by the Financial Services Compensation Scheme (FSCS)

- Money and investments held in custody as per FCA rules

Education

There's a library of articles and guides on a range of topics relevant to investors, and all are designed to be read by absolute beginners. It's complemented by some helpful explanations dotted around the site to explain the funds and the benefits of ISAs.

Pros

- Good selection of helpful blog articles

- Designed for beginners

Cons

- No videos, all written content

- News articles aren't updated very often

- No search bar to look for topics in FAQs

Customer Service

There is only one way to contact Beanstalk customer services and that's via email. There is no phone support or web/in-app chat function, which is a problem if you need immediate help as Beanstalk doesn't commit to replying to emails in less than one day. If you want to have a back-and-forward conversation, you can imagine how frustrating that would be.

Pros

- Email address for support

- FAQs help section for answers to common questions

Cons

- No phone support

- No in-app or web chat function

- Responses by email could take 1 full business day

More info

More info

Fact

Checked

Fact

Checked

Disclosure

Disclosure

Share

Share

Read More

Read More

Verdict

Verdict